Small Business Policy Funds & Loans, Are You Stuck from the Application Step?

"The small business policy fund application is 50 pages long and I'm overwhelmed with where to start writing it."

"I'm uncertain whether our company will get approval and it takes weeks just to prepare the materials, making it difficult to decide whether to apply."

Concerns about applying for small business policy funds are not unique to our company.

Policy funds are essential opportunities and growth platforms for small businesses. However, complicated forms, stringent screening criteria, and numerous application documents act as barriers. Every year, many small business owners and financial managers give up at the application form stage for policy funds.

In this article, we detail the process from selecting the right fund for our company to tips for increasing approval chances and practical advice for writing business and financial plans.

At the end, we also introduce a method for completing policy fund applications at once using AI, so make sure to read it to the end!

Types of Small Business Loan Policy Funds, Selecting Tailored Policy Funds by Situation

Small business policy funds are commonly referred to as small business loans, Small and Medium Business Promotion Corporation (SMPPC) policy funds, SMPPC loans, and SMPPC financing.

Unlike credit loans or facility investment loans, they have the nature of low-interest loans supported by the government. Small business policy funds are representative measures for financial support to small businesses and can maximize effectiveness when combined with various financial support programs from the government and institutions.

Policy funds are broadly divided into operating funds, facility funds, and management stabilization funds.

Operating Funds

Purpose: Covering everyday operational expenses like inventory purchase, personnel costs, and rent

Recommended for: Companies with significant seasonal demand fluctuations, manufacturing/retail businesses needing capital rotation

Advantages: Relatively flexible approval conditions

Facility Funds

Purpose: Factory construction, equipment purchase, large-scale machinery investment

Recommended for: Companies planning to expand production capacity or preparing new factories or branches

Advantages: Large loan size with long-term repayment possibilities

Management Stabilization Funds

Purpose: Responding to unexpected sales declines and external risks

Recommended for: Companies experiencing temporary difficulties due to pandemics, economic downturns, etc.

Advantages: Emergency rescue nature, quick support. Character of short-term liquidity support

Self-diagnosis Method for Selecting Policy Funds Suitable for Our Company

Check the sales and profit trends over the past year.

→ If maintaining sales is urgent, operating funds are recommended, if for growth expansion, facility funds are suggested.

Review your investment plans.

→ If there is a plan for new facilities or expansion work, facility funds are suitable.

Consider recent external environmental risks.

→ If responding to temporary shocks, management stabilization funds are appropriate.

It is important to specifically define the purpose of the funds. Even a simple self-diagnosis can help set the direction for the application funds correctly.

How to Increase Approval Rates for Small Business Policy Funds?

Many people think that policy funds are easily made available for small businesses, but in reality, the screening criteria for policy funds are quite strict.

Review the checklist below and conduct a self-diagnosis of our company situation.

Policy Fund Screening Criteria and Self-diagnosis Checklist

☑️ Management of Credit Ratings and Debt Ratios

These are the indicators that financial institutions and guarantee agencies look at first.

☑️ Status of Tax Arrearages

Records of tax and social insurance arrears are detrimental.

☑️ Recent 3-year Financial Statements

Sales growth, operating profit, and net income trends are important.

☑️ Completeness of Business Plan

Technical, market, and business feasibility evaluations hold the greatest weight.

After self-diagnosing the items above, having a strategy to supplement any deficiencies can significantly raise the approval rate when writing the application.

If there is a history of tax arrears, obtaining and submitting a full payment certificate in advance or clearly presenting a plan to clear arrears will secure credibility.

If repeated losses occur in the financial statements, attaching profit improvement plans and specific recovery strategies can be beneficial.

Through pre-preparation and supplementation strategies like these, it is crucial to go beyond merely 'meeting conditions' and appeal the evaluators with trusting growth potential.

Writing a Policy Fund Application to Increase Approval Rates

There are important considerations when writing a policy fund application. Here are the guidelines for writing policy fund applications that increase approval rates.

① Understand the Intent of Each Section

In 'Company History', don't just list years; emphasize major technical developments and sales growth stories.

② Attach Supporting Materials

‘Business Objectives’ should include specific figures and achievement plans like ‘20% sales growth within 3 years’, ‘35% increase in export share’, etc.

③ Maintain a Consistent Storyline

Consistency between vision, strategy, and fund utilization plan is key to a credible policy fund application.

④ Check Alignment with Long-term Management Strategies

Applications linked with the growth strategy have higher approval rates than those focusing solely on short-term funds.

✅ Go to AI-driven Format for Writing Small Business Policy Fund Loan Applications

Writing a Business Plan for Policy Fund Applications: Important Points

Among the methods for applying for small business policy funds, the business plan is a core document determining the company's credibility. Application reviewers comprehensively evaluate the company's vision, growth strategy, market competitiveness, and fund management plan through the business plan.

Know-how for Writing Business Plan Items for Small Business Financial Support

1. Business Overview

Clearly summarize the company's key business content and vision in one paragraph

Write impactfully, detailing 'what, why, and how'

Example: ○○ is a smart logistics solution specialist for small businesses, aiming to reduce logistics costs by up to 30% through AI-based optimization technology.

Business Status

Record the current state of the business, major achievements, performances, and market share in detail

Write with a focus on figures like production volume, sales growth trends, and customer acquisition status of main products/services

Attach materials that highlight strengths like certifications, patents, and partnership contracts

Example: As of 2024, contracts secured with 5 domestic major corporations, achieving 8 billion KRW in sales, maintaining an annual growth rate of 15%. Hold ISO 9001 certification and three patents

Business Background and Market Environment

Explain market size, growth prospects, competitor analysis, and policy & regulatory environment

Emphasize points of differentiation and entry strategy

Example: The domestic smart logistics market is growing at an average annual rate of 20%, with AI logistics optimization solutions still in the early stages, offering competitive advantage for first-movers

Business Goals and Strategy

Present goals in specific figures (sales, market share, delivery destination, etc.) and detail step-by-step strategies

Divide into short-term, medium-term, and long-term strategies for writing

Example: Achieving 20 billion KRW in sales and a 10% market share by 2026. Entering overseas markets and expanding partnerships in logistics automation

Description of Products and Services

Emphasize the technological characteristics, main features, and advantages of leading products or services

Include current status (prototype, commercialization status, etc.) and plans for future improvements

Example: AI-based route optimization module improves delivery efficiency by 25% compared to competitors. Planning to add a demand prediction feature based on big data

6. Market Entry and Marketing Strategy

Detail target customer base, market entry methods, sales channels, and promotional strategies

Including initial proof results and customer feedback can be effective

Example: Direct sales to corporate logistics departments, participate in global fairs, expand online channels. Conducting joint pilots with leading domestic companies

Fund Management and Investment Plan

Write the fund usage plan in detail (R&D, facilities, marketing, etc.)

Include the required timing and expected effects

Example: Out of 1.5 billion KRW in policy funds, 800 million KRW is for AI module enhancement, 500 million KRW for logistics center facility improvement, and 200 million KRW for global marketing

Risks and Response Strategy

List the major forecasted risks (technology, market, funds, etc.)

Propose specific countermeasures for each risk

Example: If competitors enter the technology space, respond with increased R&D investment and additional new product lineup. If market demand fluctuates, pursue diversification strategies

Expected Outcomes and Conclusion

Include specific outcomes anticipated from policy fund support (sales, job creation, social contributions, etc.)

Including additional value like ESG, eco-friendliness, local community contributions can yield bonus points

Example: Achieving 25 billion KRW in annual sales, creating 40 new jobs, contributing to digitalization of domestic and international logistics industries with policy fund support

Utilizing tables and graphs for each item can strengthen visual persuasion. Particular attention should be paid when writing items that demand specific evidence like market reports, certificates, patents, and contracts.

Writing a Financial Plan for Policy Fund Applications: Important Points

The financial plan serves as an indicator for determining the stability and future viability of the applicant company.

The review agency closely analyzes repayment ability, future profitability, and cash flow management skills through the financial plan.

Know-how for Writing Items of the Financial Plan

Write expected figures based on logical evidence

Include specific evidence like past performance, market research data, sales increase/decrease scenarios.

Maintain consistency

The capital utilization plan in the business plan must match the financial statement.

Clearly categorize detailed items

Essential to differentiate stages like budget, sales, operating income, and net income.

Clarify the cash flow

It needs mutual verification between profit and loss statement, funding plan, and cash flow statement.

Each Policy Fund Application Agency Requires Different Specifications and Format Responses

The policy fund hosting agencies include the Small and Medium Venture Business Corporation (SMPPC), Credit Guarantee Fund, and Technology Guarantee Fund, among others.

Each agency applies different screening criteria and document requirements, posing a high risk of rejection if not accurately understood.

Check the precautionary items below in advance, and writing the application can improve the likelihood of approval.

Precautions When Writing and Submitting Policy Fund Application Documents

Check Evaluation Elements per Agency

SMPPC policy funds are supported based on evaluations of technical, growth, and market potential. SMPPC loan conditions typically include credit evaluations, financial soundness, and practicality evaluations of business plans.

Credit Guarantee Fund focuses on collateral capability, while Technology Guarantee Fund emphasizes growth potential.

Use the Latest Policy Fund Application Formats

Ensure to check the latest format attached to the announcement before writing.

SMPPC Policy Funds are available on the website under 'Various Forms', and SMPPC loan conditions are updated on a quarterly basis. Credit Guarantee Fund might require collateral providing proof, and Technology Guarantee Fund may ask for separate forms like technical business plans (Refer to Technology Business Plan Preparation Video), so make sure to check the list of attached materials mentioned in the announcement.

Prepare Supplementary Materials

Preparing in advance for appendices, PT materials, simulation files, etc., which may be additionally requested by agencies, is convenient.

Completing Small Business Policy Fund Applications All at Once with AI Automation

When writing policy fund application documents, actual completion of high-quality documents can be difficult due to time constraints or lack of specialized personnel.

By utilizing inline AI, you can complete policy fund applications all at once.

How to Write Policy Fund Applications Using AI

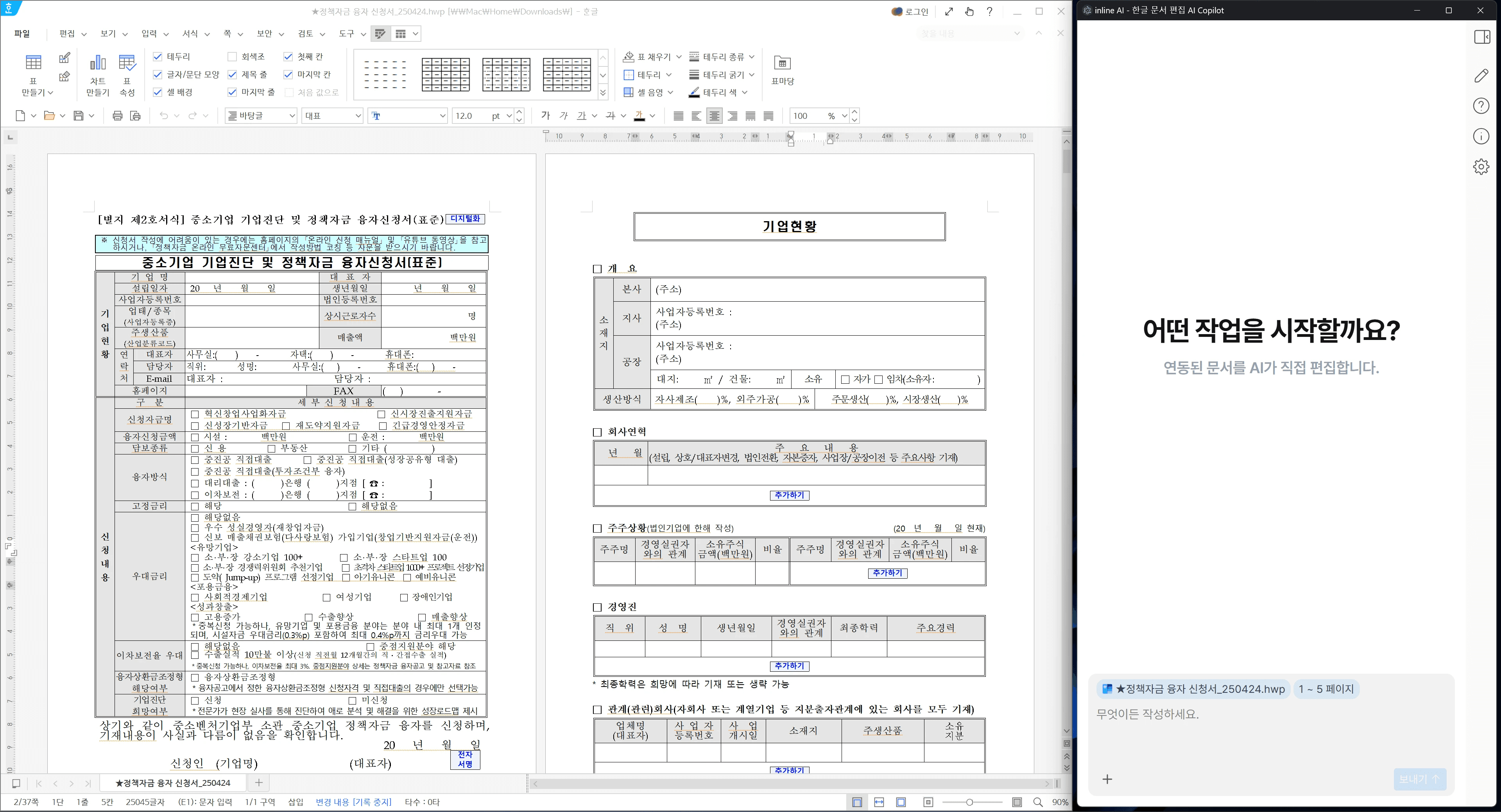

1️⃣ Upload Application Form

Upload the downloaded policy fund application form as is.

Automatically recognizes any format from any agency, be it PDF, Hangul, Word, etc.

2️⃣ Simple Entry of Core Information

Simply enter core numerical data such as basic company information (business type, history, key products, organization, etc.), sales, costs, and anticipated investment.

No need to write long sentences in detail, short descriptions at the keyword level are sufficient.

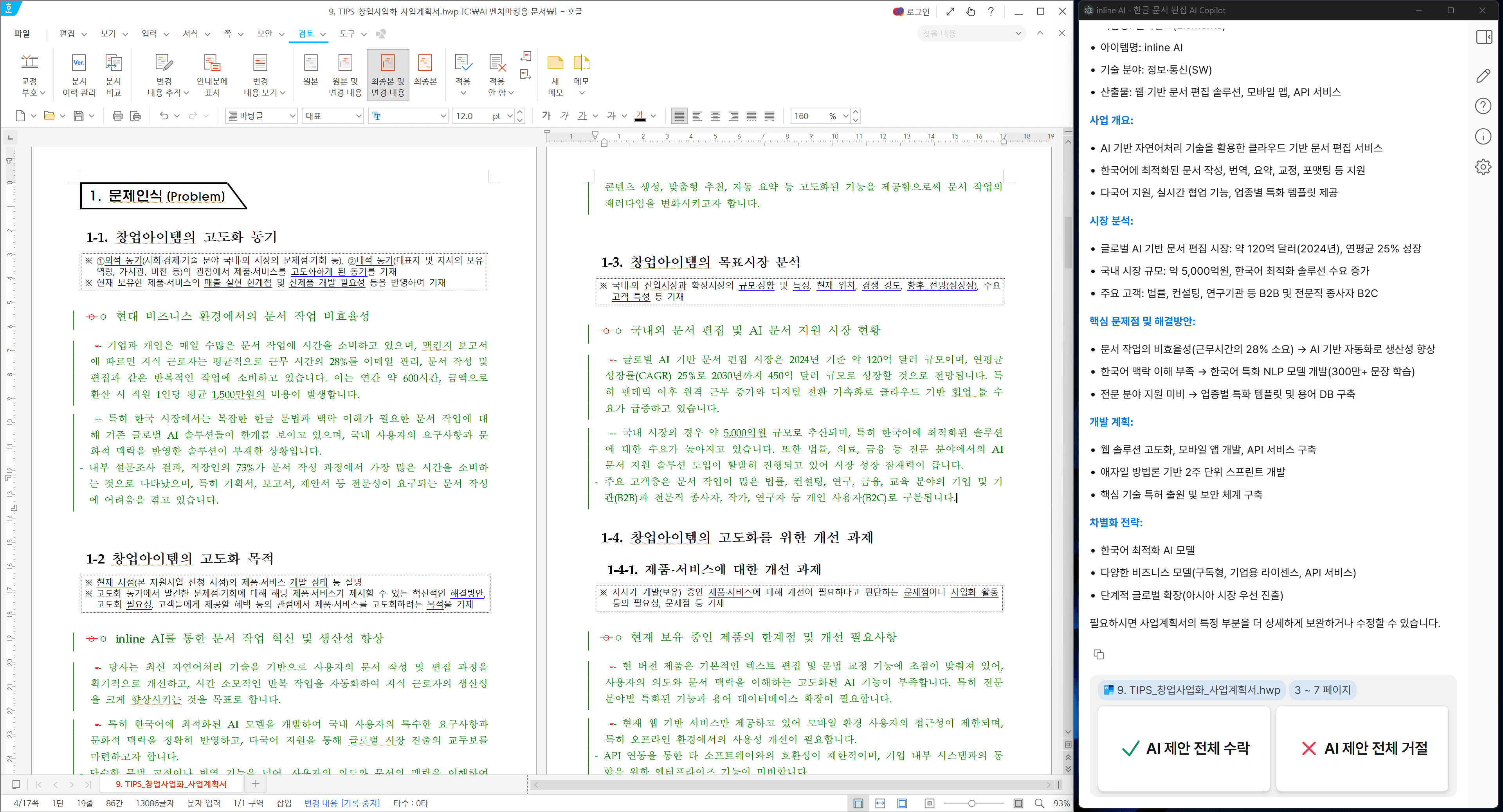

3️⃣ AI Auto Mapping and Writing of Application Items

AI analyzes the uploaded form to automatically understand the intent of each section (e.g., business status, investment plan).

Combines input information with the existing database to auto-complete appropriate sentences for each section.

For example, 'Business Status' includes past achievements and growth plans, while 'Capital Utilization Plan' automatically incorporates investment details and cost allocation.

4️⃣ Auto-Generation of Tables and Graphs

Complete complex tables and graphs such as profit and loss statements or cash flow charts automatically.

Based on the entered numerical data, incorporate calculations and format specifications to compose the table, providing customized, visually clean results.

5️⃣ Real-Time Risk Review and Supplement

During document writing, AI indicates legal/procedural risks in real-time.

Inform of omitted sections, incorrect flows, and illogical content automatically, ensuring high completeness without separate expert review.

6️⃣ Final Completion and Printing

The completed document can be downloaded in various formats such as Hangul (HWP), Word (DOCX), PDF immediately and can be submitted to agencies without separate editing.

Once the content is entered, even if the format changes, the existing content can be reused, making agency-specific adaptations possible.

inline AI employs a local-based RAG system, processing all data on the user's PC. It ensures safe usage without worries about leaking confidential company information.

Complete Your Policy Fund Application with AI

Don't give up applying for complex policy funds due to complicated applications anymore. By leveraging inline AI, you can achieve consulting-level results for policy funds.

90% reduction in policy fund application writing time

Achieve high completeness to increase approval rates

Tailor to fit our company with customized writing