Are you spending valuable time writing pitch decks and business plans?

Founders of early-stage startups often say:

“There’s a lot of material to introduce our company, but I don't know where to start or how to organize it.”

Preparing a pitch deck ahead of an investment meeting is never straightforward.

Despite having strong technical skills and sufficient market insights, expressing them in a well-organized document tailored to investors is a completely different challenge.

Particularly for early-stage startups with limited manpower, the founder must handle everything from planning to design and strategy.

💡In this article, we introduce a document-generating AI that dramatically reduces the time needed to prepare investment proposal documents, and

specifically detail how the pitch deck writing process can be automated.

Pitch deck, IR deck, business plan, investment proposal, company introduction... why are they challenging?

Meaning of pitch deck, differences between pitch deck, IR deck, and company introduction

What is a Pitch Deck?

A pitch deck is a presentation material created by startups to introduce their business ideas to investors with the aim of attracting investment.

It typically consists of 10-15 slides that concisely embody the company’s vision, the problem it aims to solve, solutions, market size, and business model.

Differences between Pitch Deck, Company Introduction, and IR Deck

Pitch decks, company introductions, and IR decks each have different purposes.

While the company introduction is a general document designed to convey comprehensive information about the company to various stakeholders such as customers, partners, and job seekers, the pitch deck is exclusively targeted at investors for the purpose of securing investment.

In comparison to the IR deck, which provides detailed financial information and strategic analysis for investors who have already shown interest, the pitch deck is a concise and impactful document designed to grab the initial interest of investors.

The pitch deck focuses on storytelling to effectively “pitch the value proposition” of the investment.

Reasons for experiencing difficulty in writing a pitch deck

1️⃣ Time-consuming manual organization of internal documents

Gathering and organizing information scattered throughout the company, such as technical documents, product materials, and user reports, can take several days.

There is significant time expenditure in integrating documents maintained in different forms and formats, and in processing them into a format easily understood by investors.

Additionally, verifying and validating the latest data requires considerable resource input and communication, delaying the pitch deck production schedule.

2️⃣ Discrepancies between technical documents and investor-focused language

CEOs or founders from engineering or developer backgrounds often struggle to explain their company's technology and product competitiveness in the “business value” language of investors.

Translating technical excellence into business indicators that investors consider important, such as market opportunity, profitability, and scalability, is challenging.

As a result, despite possessing exceptional technological capabilities, many fail to appropriately showcase their value to investors, ultimately resulting in missed investment opportunities.

3️⃣ Inefficacy of improving past investment documents

Due to the lack of systematic management of past pitch decks and business plans, the process of searching for, comparing, and updating necessary content is repeatedly undertaken.

Feedback received from investors or past questions are often not properly organized, resulting in the repetition of the same mistakes or failure to rediscover already verified good content.

This hampers the improvement of the quality of pitch decks and creates inefficiencies, making the investment attraction process feel like starting anew.

4️⃣ Varied formats and emphasis points for different VCs

Due to different content and format requirements by various investors such as market VCs, technology VCs, and ESG VCs, the same content needs to be rewritten differently each time.

For instance, technology VCs may be more focused on patents or technological differentiation, while market VCs may show greater interest in TAM (Total Addressable Market) or customer acquisition strategies.

Preparing tailored materials for investors with different interests and evaluation criteria demands significant time and effort, with potential risks of losing consistency or diluting core messages.

Try writing pitch decks and company introductions with AI

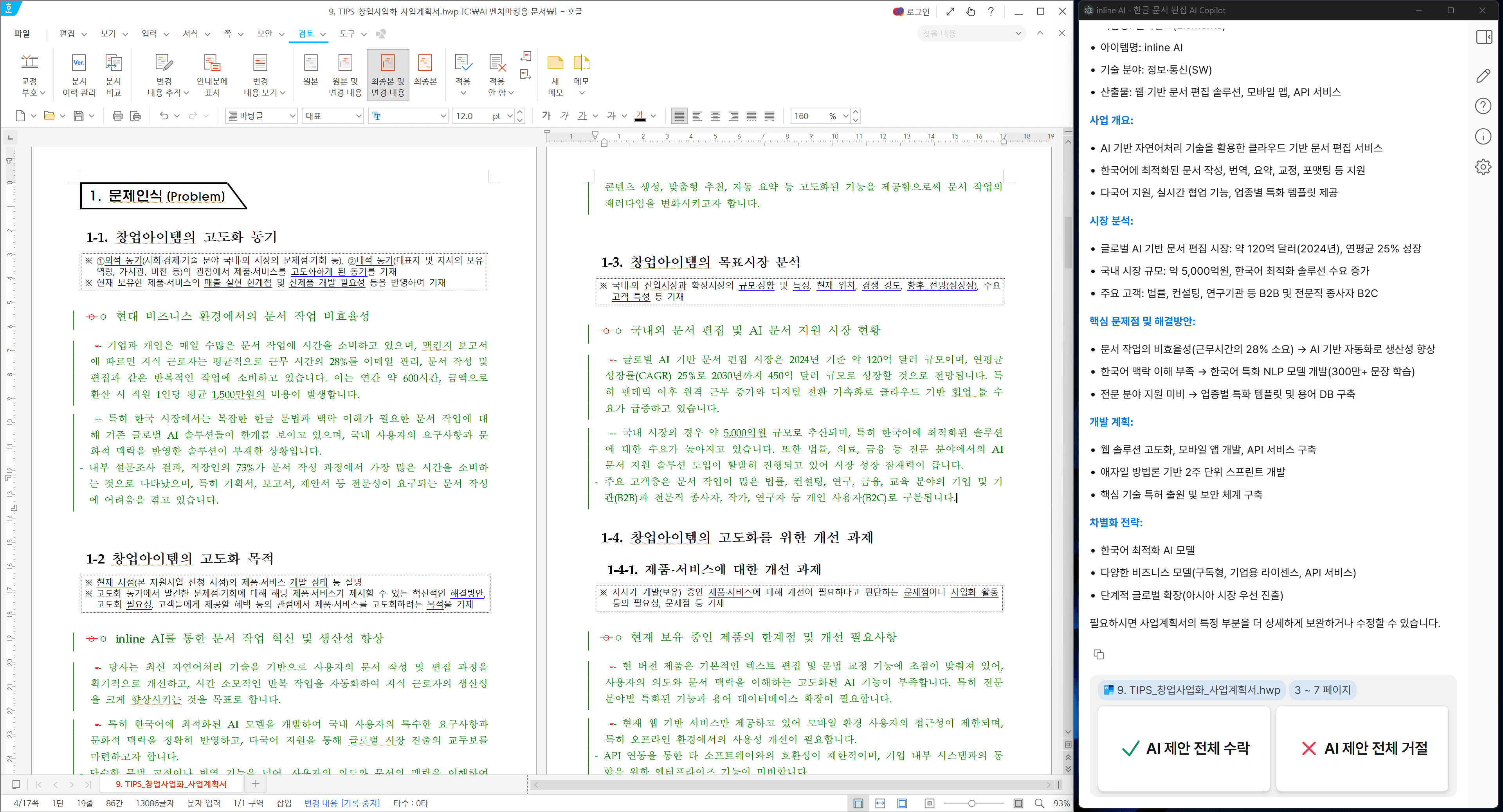

Inline AI developed specifically for Korean corporate and startup executives

1️⃣ Automatic data collection, summarization, and storytelling

When you upload basic materials required for writing a pitch deck to Inline AI, the complex organization process is conducted automatically.

Various forms of company-related materials and product documents (including intellectual property like patents and certificates), detailed service descriptions, market research reports and related news, team profile and career information, previous pitch decks, and IR documents can be processed at once.

Uploaded materials are automatically categorized and organized using the RAG (Retrieval-Augmented Generation) framework.

Extracted data is not merely listed but restructured in an easy-to-understand storytelling format from the investor's perspective, making it complete with convincing stories via templates focused on key investment points like business models, market structure, and competitive advantage.

2️⃣ Application of VC-specific pitch deck templates

By inputting a simple prompt requesting a business plan tailored to the characteristics of each VC, customized documents for each investor are automatically generated.

According to the investor's tendencies, such as market VCs, technology VCs, or ESG VCs, key components and emphasis order, message tone are automatically adjusted.

For example, when targeting technology VCs, elements of patents or technological differentiation are placed upfront, while TAM or customer acquisition strategies are emphasized for market VCs.

Even the same content can be instantly converted into pitch decks reflecting format, expression style, and emphasis points aligned with the interests of each investor, maximizing efficiency.

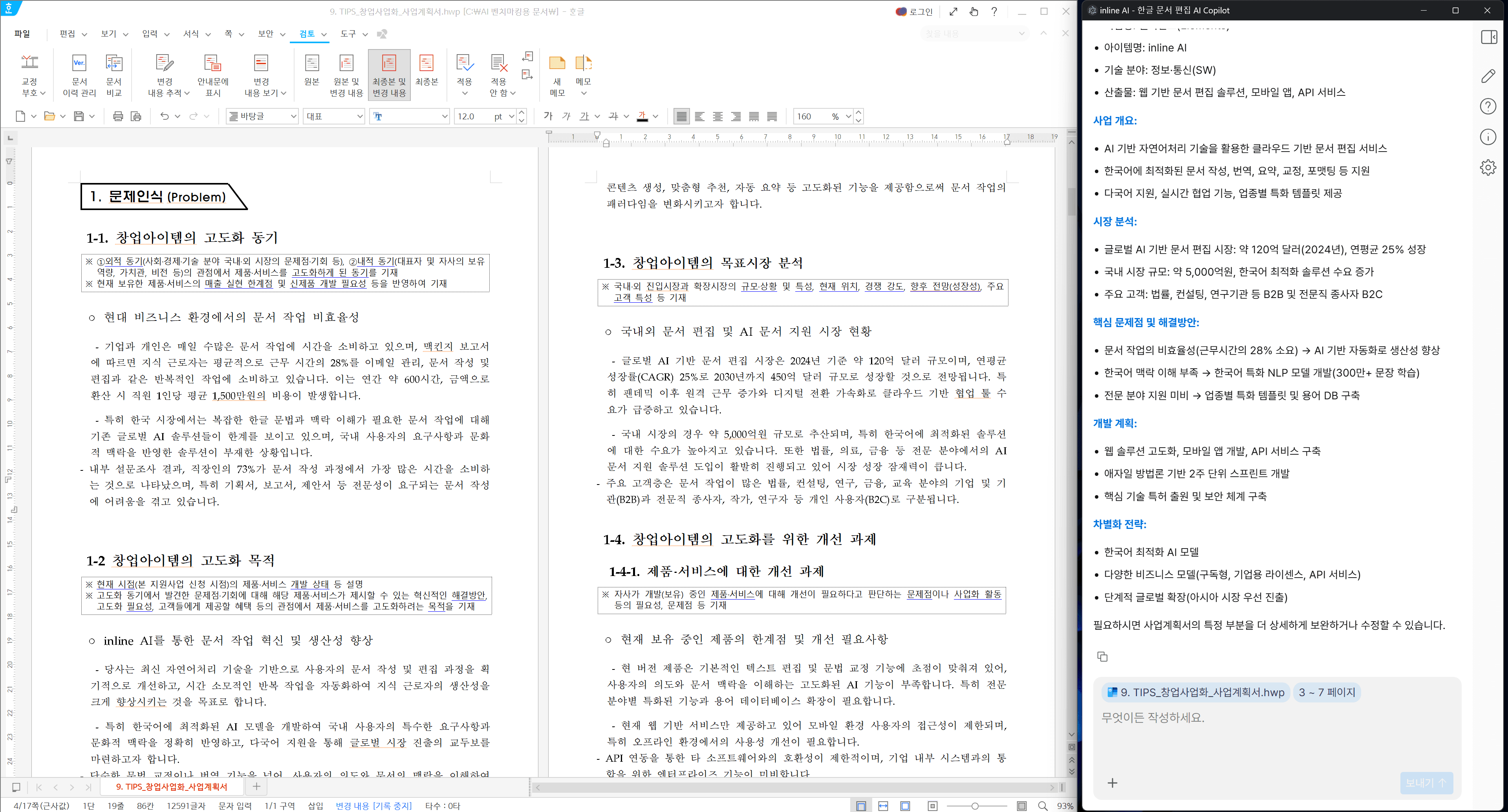

3️⃣ Learning from and improving past documents

When existing documents are uploaded and areas needing improvement are requested, systematic analysis along with specific improvement plans are provided.

You don't need to rewrite the content entirely; just specify the sections that require updates for quick and accurate revisions.

Additionally, professional suggestions for improving consistency of logic structure, message conveyance, and supplementary persuasive points automatically enhance the completeness of the pitch deck.

Thus, rather than simply storing past documents, they can be utilized as continuously evolving strategic assets.

Inline AI reduces company introduction writing time by 80%

Inline AI transcends traditional document writing tools to innovate the entire pitch deck creation process with a comprehensive solution.

It automates the entire process from gathering various materials to investor-specific reorganization, format conversion, and storyline structuring, achieving over 80% time reduction compared to previous methods.

Complex technical data and market analysis materials are automatically converted into business language easily understood by VCs, structured in a storytelling manner to maximize document persuasiveness. Uploading previous versions of documents enables automatic diagnosis and improvement, as well as version control, allowing pitch deck histories to be utilized as systematic strategic assets.

In particular, real-time reflection of formats and emphasis points aligned with various VC investment tendencies, such as market, technology, ESG, enables the simultaneous creation of multiple customized pitch decks, greatly enhancing the efficiency of investment attraction activities.

✅ Inline AI reduces pitch deck writing time by over 80%

Complete from gathering various materials to investor-specific reorganization, format conversion, and storyline structuring within hours.

✅ Inline AI automatically completes persuasive IR documents

Convert complex technical and market data into VC language, structured in storytelling manner to maximize persuasiveness.

✅ Inline AI transforms past documents into strategic assets

Upload previous versions of documents for automatic diagnosis, improvement, and version upgrades, enabling systematic pitch deck history management.

✅ Inline AI provides real-time customized pitch decks for VCs

Instantly reflect formats and emphasis points aligned with market, technology, ESG VC characteristics, enabling simultaneous creation of multiple versions.

Especially recommended for these individuals

Inline AI is optimized for early-stage startups preparing to attract investment.

It is particularly useful for founders and CEOs/CTOs of technology-based companies facing IR meetings such as Series A and pre-A.

Additionally, it is strongly recommended for teams with abundant technical and market data but lacking the time to organize it into investment materials, or for startup operatives interested in document automation to enhance work efficiency.

📍Founders of early-stage startups approaching Series A, pre-A, IR (investment proposal) meetings

📍CEO or CTO of technology-based companies

📍Teams with abundant data but lacking time to organize it into practical investment materials

📍Startup operatives interested in business plans, pitch decks, document automation

Fundamental changes in company introduction, pitch deck, and IR deck writing process

The introduction of Inline AI fundamentally changes the investment preparation process for startups. It completely eliminates the time consumed by repetitive data collection and organization tasks, securing a persuasively expert-level pitch deck draft in a short time.

Automatic document optimization tailored to investor requirements is achieved, minimizing resources previously consumed by version management and repeated revisions. As a result, founders and key team members can focus on essential business strategy formulation and investor networking rather than subsidiary tasks like pitch deck writing.

From now on, things will be different

💡 ZERO time wasted on repetitive data collection and organization

💡 Complete a persuasively expert-level pitch deck draft in a short time

💡 Automatic optimization of documents according to investor requirements

💡 Minimized resources previously consumed by version management and revisions

👉🏻 Check it for free now.

You can use it for free right away.

Significantly reduce the time required for preparing investment meetings.